Capricorn remains resilient amidst Covid

Capricorn Group’s operating profit in its 2021 financial year was the lowest since 2018.

Jo-Maré Duddy – Locally-listed Capricorn Group, with Bank Windhoek as its flagship brand, has provided payment holidays on loans freeing up N$343 million in cash flow to its clients, as well as committed and spent N$17.1 million in cash towards Covid-19 and other social relief measures since the start of the pandemic in March last year.

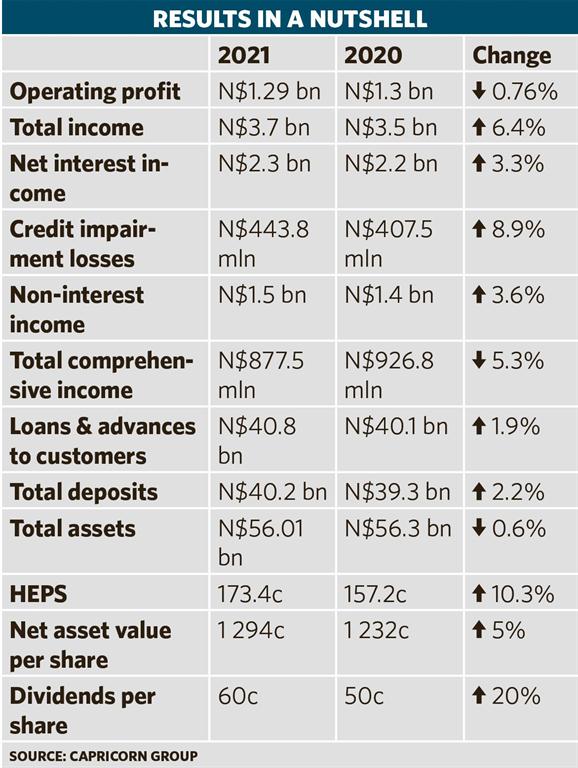

The group, the third biggest on the Local Index of the Namibian Stock Exchange (NSX) in terms of total market capitalisation, on Thursday reported an operating profit of more than N$1.29 billion for the year ended 30 June 2021, down nearly 0.8% from its previous book-year.

This is Capricorn’s lowest operating profit since 2018 when it was nearly N$1.17 billion. In 2019 and 2020, the figure was around N$1.33 billion and N$1.3 billion respectively.

“Despite the business being exposed to the direct and indirect impact of the Covid-19 pandemic on various levels, Capricorn Group showed tremendous resilience and performed much better than anticipated 12 months ago,” the company commented on its latest set of results.

“I am pleased with the commendable performance of the group against all the odds,” group chief executive officer Thinus Prinsloo said.

‘ABOVE EXPECTATIONS’

He continued: “I wish to thank each employee in Namibia, Botswana and South Africa and celebrate the way that they have persevered and adapted to new and uncertain conditions whilst maintaining customer service levels and delivering on our strategic choices. All our subsidiaries performed above expectations and have managed to grow or maintain market share during the financial year, giving the group a strong foundation to continue growing and expanding its leadership in the various markets.”

According to Prinsloo, Capricorn has a dynamic business model to create and preserve value while remaining true to our group’s purpose.

“The group has a real competitive strength in local decision-making, especially in the way it affects customers. This is our main driver for growing market share,” he said.

Jaco Esterhuyse, Capricorn’s group financial director, commented: “The financial results of Capricorn Group in the current economic environment are a remarkable achievement and evidence of the dedication, personal commitment and resilience of our employees. Our results demonstrate how Capricorn Group used our advantage of being local, nimble, and responsive.

“We were able to preserve and grow value for our stakeholders even though Namibia’s economy was in a recession before the Covid-19 pandemic and had to deal with the economic and social shock brought about by Covid-19. During the year, we also disposed of our loss-making Zambian operations,” he added.

Losses from discontinued operations decreased by N$114.4 million or 73.5% year-on-year (y/y) after the disposal of Cavmont Bank Ltd on 4 January 2021.

INCOME

Net interest income and interest margins were under pressure following unprecedented interest rate cuts of 250 basis points in Namibia and 100 basis points in Botswana between March 2020 and September 2020, Capricorn said. Notwithstanding this, the group’s net interest income before impairment charges increased by 3.3% y/y to N$2.26 billion.

Non-interest income increased by 3.6% y/y to N$1.48 billion, significantly supported by diversified income streams from asset management and life assurance businesses, according to Capricorn. Bank Windhoek and Bank Gaborone increased non-interest income by 4.3% and 28.8% respectively, mainly from increased transaction volumes.

“The diversification strategy of the group continues to deliver good results with a significant increase of 62.6% in income from associates compared to the prior year,” Capricorn said, adding that the growth was mainly due to a N$29.7 million increase in the contribution from Paratus Group. The contribution from associates to the group profit after tax increased from 6.3% in the prior year to 10.1%.

EXPENSES, ASSET QUALITY

The group focused on incurring only essential spending to ensure it remains competitive and sustainable for the future, Capricorn said.

Operating expenses increased by 5.1% y/y compared to the prior year’s 3.4% increase. Technology costs increased by 12.6% y/y (2020: 36.6%) largely due to weaker Namibian and Botswana currencies. The investment in growing the group’s digital offerings also contributed to the increased IT cost.

Asset quality continues to be a key focus of the group whilst supporting its customers through very difficult times brought on by the pandemic, Capricorn said.

Bank Windhoek grew loans and advances by 4% y/y, well above the private sector credit extension of 2.7%, as it continues to be the market leader in Namibia, according to Capricorn.

The pandemic’s impact on sectors such as travel, tourism, hospitality and construction resulted in deferments of instalments and increased non-performing loans (NPLs), it said. Capricorn Group’s total NPLs increased from N$1.92 billion to N$2.46 billion (28.1%), resulting in an increase in the NPL ratio from 4.7% to 5.2%.

LIQUIDITY

“Liquidity is a key priority for Capricorn Group. Maintaining appropriate levels of liquidity always takes preference over profit optimisation,” the company said.

“Liquid assets remained well above regulatory requirements. As of 30 June 2021, Bank Windhoek’s liquid assets showed a surplus of N$3.1 billion over the Bank of Namibia minimum liquid asset requirements, while Bank Gaborone had a surplus of BWP681.4 million above Bank of Botswana requirements.”

The Group remains well capitalised with a total risk-based capital adequacy ratio of 15.0% (2020:14.7%), well above the minimum regulatory capital requirement of 10%.

The group remains “concerned about the impact of the general constrained economy, which will, unfortunately, continue to impact our business in the foreseeable future”.

“We remain committed to growing a stable and sustainable business to the benefit of all our stakeholders with our strong capital and liquidity position, diversified operations, deep local knowledge and strong relationships”, concluded Prinsloo.

The group, the third biggest on the Local Index of the Namibian Stock Exchange (NSX) in terms of total market capitalisation, on Thursday reported an operating profit of more than N$1.29 billion for the year ended 30 June 2021, down nearly 0.8% from its previous book-year.

This is Capricorn’s lowest operating profit since 2018 when it was nearly N$1.17 billion. In 2019 and 2020, the figure was around N$1.33 billion and N$1.3 billion respectively.

“Despite the business being exposed to the direct and indirect impact of the Covid-19 pandemic on various levels, Capricorn Group showed tremendous resilience and performed much better than anticipated 12 months ago,” the company commented on its latest set of results.

“I am pleased with the commendable performance of the group against all the odds,” group chief executive officer Thinus Prinsloo said.

‘ABOVE EXPECTATIONS’

He continued: “I wish to thank each employee in Namibia, Botswana and South Africa and celebrate the way that they have persevered and adapted to new and uncertain conditions whilst maintaining customer service levels and delivering on our strategic choices. All our subsidiaries performed above expectations and have managed to grow or maintain market share during the financial year, giving the group a strong foundation to continue growing and expanding its leadership in the various markets.”

According to Prinsloo, Capricorn has a dynamic business model to create and preserve value while remaining true to our group’s purpose.

“The group has a real competitive strength in local decision-making, especially in the way it affects customers. This is our main driver for growing market share,” he said.

Jaco Esterhuyse, Capricorn’s group financial director, commented: “The financial results of Capricorn Group in the current economic environment are a remarkable achievement and evidence of the dedication, personal commitment and resilience of our employees. Our results demonstrate how Capricorn Group used our advantage of being local, nimble, and responsive.

“We were able to preserve and grow value for our stakeholders even though Namibia’s economy was in a recession before the Covid-19 pandemic and had to deal with the economic and social shock brought about by Covid-19. During the year, we also disposed of our loss-making Zambian operations,” he added.

Losses from discontinued operations decreased by N$114.4 million or 73.5% year-on-year (y/y) after the disposal of Cavmont Bank Ltd on 4 January 2021.

INCOME

Net interest income and interest margins were under pressure following unprecedented interest rate cuts of 250 basis points in Namibia and 100 basis points in Botswana between March 2020 and September 2020, Capricorn said. Notwithstanding this, the group’s net interest income before impairment charges increased by 3.3% y/y to N$2.26 billion.

Non-interest income increased by 3.6% y/y to N$1.48 billion, significantly supported by diversified income streams from asset management and life assurance businesses, according to Capricorn. Bank Windhoek and Bank Gaborone increased non-interest income by 4.3% and 28.8% respectively, mainly from increased transaction volumes.

“The diversification strategy of the group continues to deliver good results with a significant increase of 62.6% in income from associates compared to the prior year,” Capricorn said, adding that the growth was mainly due to a N$29.7 million increase in the contribution from Paratus Group. The contribution from associates to the group profit after tax increased from 6.3% in the prior year to 10.1%.

EXPENSES, ASSET QUALITY

The group focused on incurring only essential spending to ensure it remains competitive and sustainable for the future, Capricorn said.

Operating expenses increased by 5.1% y/y compared to the prior year’s 3.4% increase. Technology costs increased by 12.6% y/y (2020: 36.6%) largely due to weaker Namibian and Botswana currencies. The investment in growing the group’s digital offerings also contributed to the increased IT cost.

Asset quality continues to be a key focus of the group whilst supporting its customers through very difficult times brought on by the pandemic, Capricorn said.

Bank Windhoek grew loans and advances by 4% y/y, well above the private sector credit extension of 2.7%, as it continues to be the market leader in Namibia, according to Capricorn.

The pandemic’s impact on sectors such as travel, tourism, hospitality and construction resulted in deferments of instalments and increased non-performing loans (NPLs), it said. Capricorn Group’s total NPLs increased from N$1.92 billion to N$2.46 billion (28.1%), resulting in an increase in the NPL ratio from 4.7% to 5.2%.

LIQUIDITY

“Liquidity is a key priority for Capricorn Group. Maintaining appropriate levels of liquidity always takes preference over profit optimisation,” the company said.

“Liquid assets remained well above regulatory requirements. As of 30 June 2021, Bank Windhoek’s liquid assets showed a surplus of N$3.1 billion over the Bank of Namibia minimum liquid asset requirements, while Bank Gaborone had a surplus of BWP681.4 million above Bank of Botswana requirements.”

The Group remains well capitalised with a total risk-based capital adequacy ratio of 15.0% (2020:14.7%), well above the minimum regulatory capital requirement of 10%.

The group remains “concerned about the impact of the general constrained economy, which will, unfortunately, continue to impact our business in the foreseeable future”.

“We remain committed to growing a stable and sustainable business to the benefit of all our stakeholders with our strong capital and liquidity position, diversified operations, deep local knowledge and strong relationships”, concluded Prinsloo.

Kommentar

Allgemeine Zeitung

Zu diesem Artikel wurden keine Kommentare hinterlassen