Caught in controversy

The local fishing industry’s contribution to the gross domestic product has been falling from an average of 4.7% in 2000 to 2004 to 2.7% last year.

Jo-Maré Duddy – Namibia’s fishing sector continues to find itself in stormy waters and is set this year for its first contraction since 2015.

The Bank of Namibia (BoN) in its Economic Outlook in August forecast growth of -8.4% for 2020, a lot murkier than the 1.1% it predicted in July 2019 for this year.

The central bank attributes its latest forecast to Covid-19 travel restrictions and lockdowns which has hit the industry “hard”.

Cirrus Securities shares the BoN’s gloomy outlook.

In its updated Economic outlook released in August, Cirrus forecast growth of -8.9% for fishing and fish processing on board. In the beginning of 2020, the analysts still expected growth of 0.5%.

Unlike the BoN, Cirrus doesn’t blame the expected poor performance on the impact of the Covid-19 pandemic. Rather, they say, “the sector is likely to be plagued by poor landings, further allegations of corruption, inefficiencies and rent seeking, as well as uncertainty as to future quota allocations”.

After contracting by 9.2% in 2015, fishing and fish processing on board recorded a growth spurt of 11.7% in 2016. In the following two years, the sector performed dismally, growing by 0.8% and 0.1% respectively.

According to the Namibia Statistics Agency (NSA), the sector grew by 6.1% last year. The increase was mainly reflected in the landings of demersal fisheries that recorded a positive growth, the NSA says.

FISHY

The allocation of fishing quotas in Namibia has been marred in controversy for years.

The sector’s woes worsened late last year when the industry made international headlines with the Fishrot corruption scandal.

Earlier this month, finance minister Iipumbu Shiimi reported on the outcome of government’s fish quota auction which showed it was a fiasco. Of the N$628 million government thought it would generate through the auction, only N$8.5 million materialised.

Industry calculations based on the average amount for which companies could have sold the fish, showed the economy lost more than N$1.5 billion.

Shiimi admitted that poor planning sunk the auction as it happened too late in the season.

The minister of fisheries and marine resources, Albert Kawana, subsequently assured the industry that fishing will commence as soon as the new season starts.

Poor landings, further allegations of corruption, inefficiencies and rent seeking, as well as uncertainty as to future quota allocations will “severely hamper growth and investment going forward, particularly the stain of large-scale corruption”, says Cirrus.

“Confidence in government and the sector needs to be restored,” the analysts say.

TRADE CATCH

Fish was Namibia’s top food item export revenue earner last year. In addition, it was the fourth biggest export revenue earner overall.

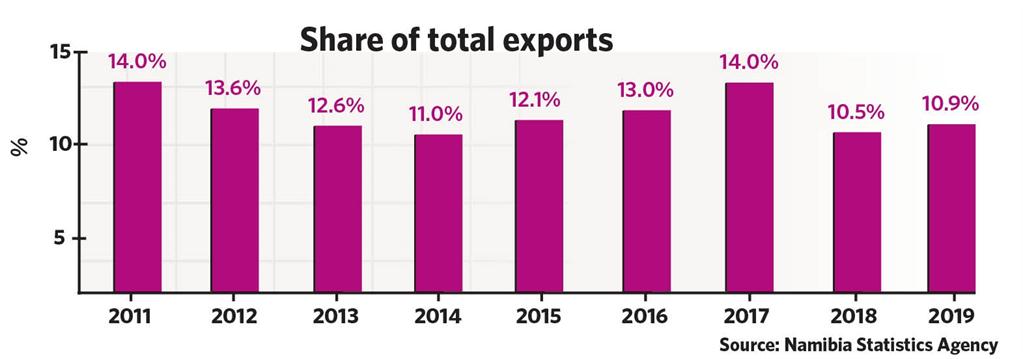

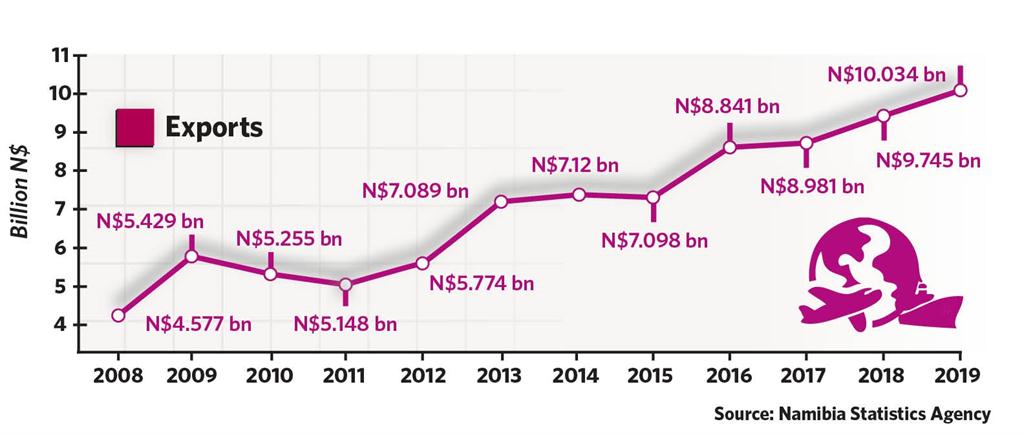

According to NSA data, fish to the tune of N$10.03 billion was exported last year, 3% more than in 2018. It constituted about 10.9% of Namibia’s total exports compared to around 10.5% in 2018.

According to the NSA, Namibia on average exported fish worth nearly N$7.51 billion from 2010 to 2019. Exports reached an all-time high of N$10.034 billion in 2019 and a record low of N$5.148 billion, below average, in 2011.

“Analysis of the fish export for the period 2010 to 2019 indicates variances in the trend starting with consecutive declines of 3.2% in 2010 and 2% in 2011, but then turned to an upward trend from 2012 reaching up to N$7.12 billion in 2014 before declining by a 0.3% to N$7.098 million in 2015,” the NSA says.

The trend picked up again registering the largest growth of 24.6% to N$8.841 billion in 2016 and rising further by 1.6% to N$8.982 billion in 2017. In 2018 it rose by 8.5% to N$9.745 billion.

“The largest contributor to the increase in fish export is Spain (Namibia’s number one importer of fish) importing fish worth N$3.928 billion in 2019 compared to N$3.56 billion a year ago,” the NSA says.

AFRICAN MARKETS

South Africa last year claimed the second position after absorbing N$1.558 billion worth of domestic fish compared to the level of N$1.494 billion in 2018.

The Democratic Republic of the Congo (DRC) clenched the third spot as the country’s export destination for fish after importing fish to the tune of N$1.161 billion from an amount of N$970 million imported in 2018r. Zambia also remained an important destination for Namibian fish as it absorbed N$1.119 billion worth of fish compared to 2018’s level of N$1.068 billion.

Cirrus points out that Namibia remains a price taker for export goods, “and so export earnings are determined to some extent by local production, but also by external prices over which we have no real influence”.

Data contained in the Fifth National Development Plan (NDP5) and the 2017/18 annual report of the Employment Equity Commission shows the fishing industry provided direct jobs to between 13 000 and 16 000 people.

According to NDP5, Namibia should be the key fisheries and processing hub in the South West Atlantic Ocean by 2022.

The Bank of Namibia (BoN) in its Economic Outlook in August forecast growth of -8.4% for 2020, a lot murkier than the 1.1% it predicted in July 2019 for this year.

The central bank attributes its latest forecast to Covid-19 travel restrictions and lockdowns which has hit the industry “hard”.

Cirrus Securities shares the BoN’s gloomy outlook.

In its updated Economic outlook released in August, Cirrus forecast growth of -8.9% for fishing and fish processing on board. In the beginning of 2020, the analysts still expected growth of 0.5%.

Unlike the BoN, Cirrus doesn’t blame the expected poor performance on the impact of the Covid-19 pandemic. Rather, they say, “the sector is likely to be plagued by poor landings, further allegations of corruption, inefficiencies and rent seeking, as well as uncertainty as to future quota allocations”.

After contracting by 9.2% in 2015, fishing and fish processing on board recorded a growth spurt of 11.7% in 2016. In the following two years, the sector performed dismally, growing by 0.8% and 0.1% respectively.

According to the Namibia Statistics Agency (NSA), the sector grew by 6.1% last year. The increase was mainly reflected in the landings of demersal fisheries that recorded a positive growth, the NSA says.

FISHY

The allocation of fishing quotas in Namibia has been marred in controversy for years.

The sector’s woes worsened late last year when the industry made international headlines with the Fishrot corruption scandal.

Earlier this month, finance minister Iipumbu Shiimi reported on the outcome of government’s fish quota auction which showed it was a fiasco. Of the N$628 million government thought it would generate through the auction, only N$8.5 million materialised.

Industry calculations based on the average amount for which companies could have sold the fish, showed the economy lost more than N$1.5 billion.

Shiimi admitted that poor planning sunk the auction as it happened too late in the season.

The minister of fisheries and marine resources, Albert Kawana, subsequently assured the industry that fishing will commence as soon as the new season starts.

Poor landings, further allegations of corruption, inefficiencies and rent seeking, as well as uncertainty as to future quota allocations will “severely hamper growth and investment going forward, particularly the stain of large-scale corruption”, says Cirrus.

“Confidence in government and the sector needs to be restored,” the analysts say.

TRADE CATCH

Fish was Namibia’s top food item export revenue earner last year. In addition, it was the fourth biggest export revenue earner overall.

According to NSA data, fish to the tune of N$10.03 billion was exported last year, 3% more than in 2018. It constituted about 10.9% of Namibia’s total exports compared to around 10.5% in 2018.

According to the NSA, Namibia on average exported fish worth nearly N$7.51 billion from 2010 to 2019. Exports reached an all-time high of N$10.034 billion in 2019 and a record low of N$5.148 billion, below average, in 2011.

“Analysis of the fish export for the period 2010 to 2019 indicates variances in the trend starting with consecutive declines of 3.2% in 2010 and 2% in 2011, but then turned to an upward trend from 2012 reaching up to N$7.12 billion in 2014 before declining by a 0.3% to N$7.098 million in 2015,” the NSA says.

The trend picked up again registering the largest growth of 24.6% to N$8.841 billion in 2016 and rising further by 1.6% to N$8.982 billion in 2017. In 2018 it rose by 8.5% to N$9.745 billion.

“The largest contributor to the increase in fish export is Spain (Namibia’s number one importer of fish) importing fish worth N$3.928 billion in 2019 compared to N$3.56 billion a year ago,” the NSA says.

AFRICAN MARKETS

South Africa last year claimed the second position after absorbing N$1.558 billion worth of domestic fish compared to the level of N$1.494 billion in 2018.

The Democratic Republic of the Congo (DRC) clenched the third spot as the country’s export destination for fish after importing fish to the tune of N$1.161 billion from an amount of N$970 million imported in 2018r. Zambia also remained an important destination for Namibian fish as it absorbed N$1.119 billion worth of fish compared to 2018’s level of N$1.068 billion.

Cirrus points out that Namibia remains a price taker for export goods, “and so export earnings are determined to some extent by local production, but also by external prices over which we have no real influence”.

Data contained in the Fifth National Development Plan (NDP5) and the 2017/18 annual report of the Employment Equity Commission shows the fishing industry provided direct jobs to between 13 000 and 16 000 people.

According to NDP5, Namibia should be the key fisheries and processing hub in the South West Atlantic Ocean by 2022.

Kommentar

Allgemeine Zeitung

Zu diesem Artikel wurden keine Kommentare hinterlassen