Nam economy ‘extremely fragile’

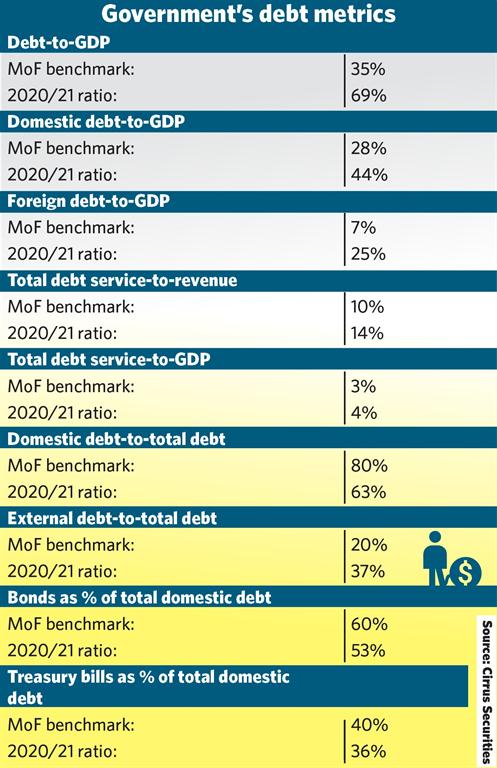

Several of government’s benchmark debt ratios have been breached in the last year.

Jo-Maré Duddy – Namibia’s economy is becoming more and more exposed to a possible debt trap and therefore is extremely fragile, Cirrus Securities says.

Issuing its latest outlook on public finances on Tuesday, Cirrus said government has breached several of its benchmark ratios in the last few years.

These metrics, published in the ministry of finance’s Sovereign Debt Management Strategy, are monitored to measure the risk of government’s debt portfolio.

Government’s debt to gross domestic product (GDP) ratio for 2020/21 is 69% - nearly twice the benchmark of 35%. According to the mid-year budget review tabled by finance minister Iipumbu Shiimi in parliament in October last year, this proportion is expected to reach 78% in 2023/24.

In 2013/14, the debt-to-GDP ratio was a mere 26%.

Commenting on the figures, Cirrus said: “What is extremely worrying, however, is that economic growth has stagnated since 2016, with contractions in 12 of the last 18 quarters, while deficits and debt increase faster than GDP.”

PRESSURE

“The Covid-19 pandemic added pressure to public finances with both an increase in expenditure and a collapse in revenue,” Cirrus said.

The analysts expect income from the income from the revenue-sharing pool of the Southern African Customs Union (SACU) in the next budget year to be “significantly lower than previous years, given the drop in exports and imports for the region thanks to lockdowns that took place during in the 2020/21 fiscal year”.

“There is risk that the prolonged impact of lockdowns, particularly in South Africa as the largest economy within SACU, could result in even lower than expected SACU disbursements,” Cirrus said.

Value-added tax (VAT) payments are equally expected to fall, according to Cirrus.

“Consumer incomes have become even more constrained, with businesses having reduced hours or retrenching workers and many households facing the burden of rising food prices.”

According to Cirrus, this will have a contagion effect.

“Declines in household incomes see individuals look to government for relief (more so where government is the cause of such misfortune), potentially increasing public expenditure, and so deficits continue to widen.”

Cirrus pointed out that this was the case with the various relief measures as part of government’s Covid-19 stimulus package.

LARGER DEFICITS

As government runs larger deficits, more and more debt is issued both in the domestic and foreign markets, including multilateral and bilateral loans, the analysts said.

“The longer the Namibian government continues to increase debt faster than (nominal) economic growth, the closer it edges towards a debt trap.”

Government’s debt service cost relative to revenue is expected to reach 14% in 2020/21.

“As more debt is to be issued, debt service costs will keep carving away from government’s limited revenue,” Cirrus said.

“In 2013/14, Government ran a N$9.3-billion deficit, at the time the largest in Namibia’s history. However, since then the budget deficit has been growing, with an average deficit of N$13 billion expected over the next three years.”

According to Cirrus, as continuously large deficits are projected, it must be questioned how they will be financed.

Issuing its latest outlook on public finances on Tuesday, Cirrus said government has breached several of its benchmark ratios in the last few years.

These metrics, published in the ministry of finance’s Sovereign Debt Management Strategy, are monitored to measure the risk of government’s debt portfolio.

Government’s debt to gross domestic product (GDP) ratio for 2020/21 is 69% - nearly twice the benchmark of 35%. According to the mid-year budget review tabled by finance minister Iipumbu Shiimi in parliament in October last year, this proportion is expected to reach 78% in 2023/24.

In 2013/14, the debt-to-GDP ratio was a mere 26%.

Commenting on the figures, Cirrus said: “What is extremely worrying, however, is that economic growth has stagnated since 2016, with contractions in 12 of the last 18 quarters, while deficits and debt increase faster than GDP.”

PRESSURE

“The Covid-19 pandemic added pressure to public finances with both an increase in expenditure and a collapse in revenue,” Cirrus said.

The analysts expect income from the income from the revenue-sharing pool of the Southern African Customs Union (SACU) in the next budget year to be “significantly lower than previous years, given the drop in exports and imports for the region thanks to lockdowns that took place during in the 2020/21 fiscal year”.

“There is risk that the prolonged impact of lockdowns, particularly in South Africa as the largest economy within SACU, could result in even lower than expected SACU disbursements,” Cirrus said.

Value-added tax (VAT) payments are equally expected to fall, according to Cirrus.

“Consumer incomes have become even more constrained, with businesses having reduced hours or retrenching workers and many households facing the burden of rising food prices.”

According to Cirrus, this will have a contagion effect.

“Declines in household incomes see individuals look to government for relief (more so where government is the cause of such misfortune), potentially increasing public expenditure, and so deficits continue to widen.”

Cirrus pointed out that this was the case with the various relief measures as part of government’s Covid-19 stimulus package.

LARGER DEFICITS

As government runs larger deficits, more and more debt is issued both in the domestic and foreign markets, including multilateral and bilateral loans, the analysts said.

“The longer the Namibian government continues to increase debt faster than (nominal) economic growth, the closer it edges towards a debt trap.”

Government’s debt service cost relative to revenue is expected to reach 14% in 2020/21.

“As more debt is to be issued, debt service costs will keep carving away from government’s limited revenue,” Cirrus said.

“In 2013/14, Government ran a N$9.3-billion deficit, at the time the largest in Namibia’s history. However, since then the budget deficit has been growing, with an average deficit of N$13 billion expected over the next three years.”

According to Cirrus, as continuously large deficits are projected, it must be questioned how they will be financed.

Kommentar

Allgemeine Zeitung

Zu diesem Artikel wurden keine Kommentare hinterlassen