Trillions needed to beat Covid hit

According to the budget tabled in May, Namibia intends borrowing N$3.23 billion this fiscal year to battle the impact of Covid-19.

African countries will need US$1.2 trillion through 2023 to repair the economic damage inflicted by the coronavirus pandemic, the managing director of the International Monetary Fund (IMF), Kristalina Georgieva, has said.

About US$345 billion in financing has not yet been pledged, Georgieva said, while commitments from official lenders and international institutions cover less than a quarter of the projected need.

The IMF has significantly increased its financial assistance to the continent, providing about US$26 billion to more than 40 countries this year, while the World Bank has provided around US$21.9 billion in loans.

Namibia in July applied to the IMF for a loan of SDR192 million through the IMF’s Rapid Financing Instrument (RFI) to help finance its record deficit of nearly N$21.4 billion in the current fiscal year.

SDR stands for special drawing rights, an international reserve asset created by the IMF to supplement its member countries’ official reserves. The value of the SDR is based on a basket of five currencies—the US dollar, euro, Chinese yuan, Japanese yen and the British pound.

The SDR value in terms of the US dollar is determined daily based on spot exchange rates. According to the IMF’s website, the US dollar on 9 October equalled nearly US$0.71.

In his maiden budget tabled towards the end of May, Shiimi made provision for Covid-19 related borrowing of N$3.23 billion.

Namibia’s total debt for 2020/21 is estimated at nearly N$117.5 billion in the budget, about 17% more than in 2019/20.

DEBT

"All of us - countries and institutions - must do more to support Africa to cope with the next phase, which is building a recovery from this crisis," Georgieva said.

The Washington-based crisis lender estimates Africa will see its GDP contract 2.5% in 2020, one of the worst downturns the continent has ever seen. And while recovery will begin next year, pre-crisis levels of growth won't be reached until 2022.

With private sector financing limited, the IMF projects a funding gap of US$44 billion for this year alone, and 43 million people could be pushed into extreme poverty on the continent, wiping out five years of progress in poverty reduction.

Meanwhile, the World Bank has said the debt of the world's poorest countries hit a record US$744 billion in 2019 prior to the coronavirus pandemic but debt relief is lagging.

The Washington-based development lender's data show debt for the 73 poorest nations grew 9.5% year-on-year, which shows "an urgent need for creditors and borrowers alike to collaborate to stave off the growing risk of sovereign-debt crises triggered by the Covid-19 pandemic."

Business shutdowns and border closures to stop the spread of Covid-19 beginning in March have devastated economies worldwide, and in April, the G20 group of large economies endorsed a debt suspension for the world's poorest countries.

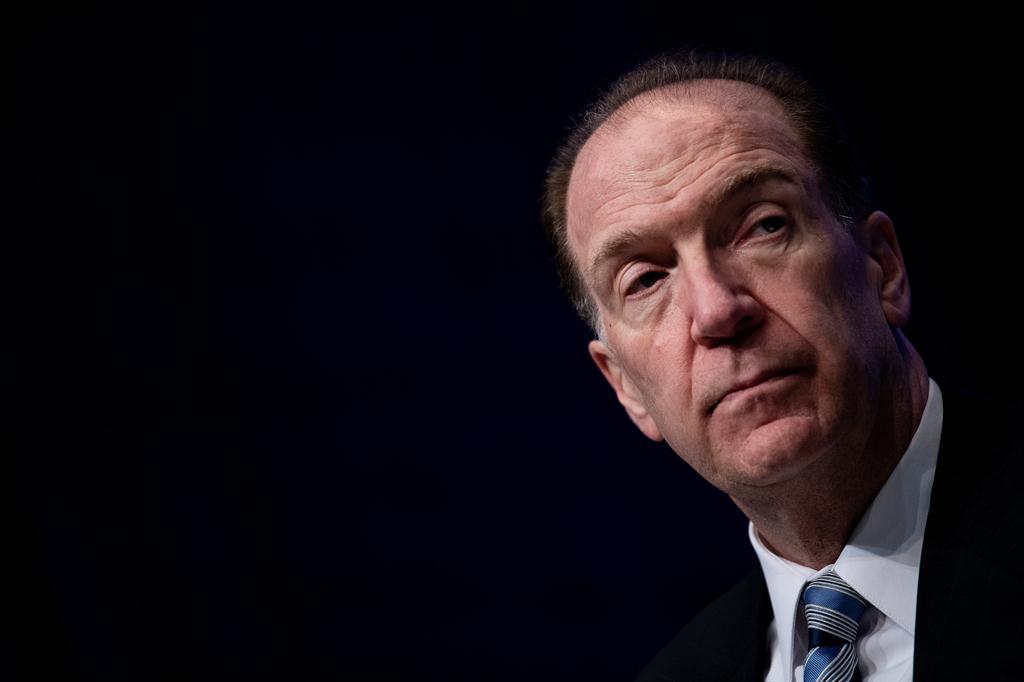

World Bank president David Malpass said relief has been weaker than expected because "not all of the creditors are participating fully," with only US$5 billion granted under the expected US$8 to US$11 billion.

The report, released as the World Bank begins its annual meetings along with the IMF, said the debt burden of the poorest countries owed to government creditors, most of whom are G20 states, reached US$178 billion last year.

CHINA

China is the largest creditor, seeing its share of debt owed to all G20 countries rise to 63% by the end of last year from 45% in 2013.

Malpass decried what he called a lack of participation by private sector creditors but also warned wealthier countries were not doing their full share.

"Some of the biggest official bilateral creditors, including some from China, are still not participating in the moratorium. And that creates a major drain on the poorest countries," he told reporters in a conference call.

Malpass again urged the need for transparency on the terms of the debt, in a reference to China, who he said in some cases have rescheduled debt principal but continues to take interest payments which could "add to the debt burden rather than relieving it."

RELIEF

G20 countries may only approve a six-month debt relief extension amid lagging commitment to the pact meant to help poor nations weather the pandemic, Malpass said.

The G20 group of largest economies is set to meet today after they pledged in April to suspend debt service from the world's poorest countries through the end of the year as they faced a sharp economic contraction caused by Covid-19.

Even with the pandemic still raging, he said another full year of debt suspension is unlikely.

"I think there will be compromise language [on] maybe a six-month extension that can be renewed depending on debt sustainability," he told reporters. – Own report and Nampa/AFP

About US$345 billion in financing has not yet been pledged, Georgieva said, while commitments from official lenders and international institutions cover less than a quarter of the projected need.

The IMF has significantly increased its financial assistance to the continent, providing about US$26 billion to more than 40 countries this year, while the World Bank has provided around US$21.9 billion in loans.

Namibia in July applied to the IMF for a loan of SDR192 million through the IMF’s Rapid Financing Instrument (RFI) to help finance its record deficit of nearly N$21.4 billion in the current fiscal year.

SDR stands for special drawing rights, an international reserve asset created by the IMF to supplement its member countries’ official reserves. The value of the SDR is based on a basket of five currencies—the US dollar, euro, Chinese yuan, Japanese yen and the British pound.

The SDR value in terms of the US dollar is determined daily based on spot exchange rates. According to the IMF’s website, the US dollar on 9 October equalled nearly US$0.71.

In his maiden budget tabled towards the end of May, Shiimi made provision for Covid-19 related borrowing of N$3.23 billion.

Namibia’s total debt for 2020/21 is estimated at nearly N$117.5 billion in the budget, about 17% more than in 2019/20.

DEBT

"All of us - countries and institutions - must do more to support Africa to cope with the next phase, which is building a recovery from this crisis," Georgieva said.

The Washington-based crisis lender estimates Africa will see its GDP contract 2.5% in 2020, one of the worst downturns the continent has ever seen. And while recovery will begin next year, pre-crisis levels of growth won't be reached until 2022.

With private sector financing limited, the IMF projects a funding gap of US$44 billion for this year alone, and 43 million people could be pushed into extreme poverty on the continent, wiping out five years of progress in poverty reduction.

Meanwhile, the World Bank has said the debt of the world's poorest countries hit a record US$744 billion in 2019 prior to the coronavirus pandemic but debt relief is lagging.

The Washington-based development lender's data show debt for the 73 poorest nations grew 9.5% year-on-year, which shows "an urgent need for creditors and borrowers alike to collaborate to stave off the growing risk of sovereign-debt crises triggered by the Covid-19 pandemic."

Business shutdowns and border closures to stop the spread of Covid-19 beginning in March have devastated economies worldwide, and in April, the G20 group of large economies endorsed a debt suspension for the world's poorest countries.

World Bank president David Malpass said relief has been weaker than expected because "not all of the creditors are participating fully," with only US$5 billion granted under the expected US$8 to US$11 billion.

The report, released as the World Bank begins its annual meetings along with the IMF, said the debt burden of the poorest countries owed to government creditors, most of whom are G20 states, reached US$178 billion last year.

CHINA

China is the largest creditor, seeing its share of debt owed to all G20 countries rise to 63% by the end of last year from 45% in 2013.

Malpass decried what he called a lack of participation by private sector creditors but also warned wealthier countries were not doing their full share.

"Some of the biggest official bilateral creditors, including some from China, are still not participating in the moratorium. And that creates a major drain on the poorest countries," he told reporters in a conference call.

Malpass again urged the need for transparency on the terms of the debt, in a reference to China, who he said in some cases have rescheduled debt principal but continues to take interest payments which could "add to the debt burden rather than relieving it."

RELIEF

G20 countries may only approve a six-month debt relief extension amid lagging commitment to the pact meant to help poor nations weather the pandemic, Malpass said.

The G20 group of largest economies is set to meet today after they pledged in April to suspend debt service from the world's poorest countries through the end of the year as they faced a sharp economic contraction caused by Covid-19.

Even with the pandemic still raging, he said another full year of debt suspension is unlikely.

"I think there will be compromise language [on] maybe a six-month extension that can be renewed depending on debt sustainability," he told reporters. – Own report and Nampa/AFP

Kommentar

Allgemeine Zeitung

Zu diesem Artikel wurden keine Kommentare hinterlassen